Looking to grab Bitcoin ahead of the next bull run? You need to read this

As the BTC available for purchase continues to dip, future buyers might have to pay significantly higher prices to grab the king coin.

Bitcoin’s exchange balance amounted to just 11.5% of the total circulating supply.

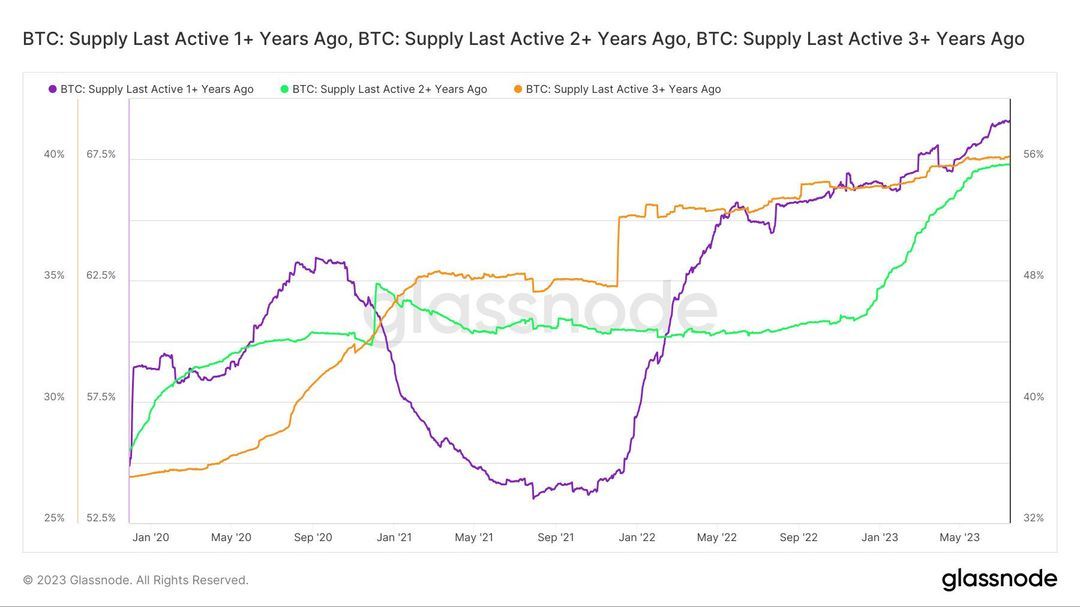

Dormant supply pushed to new highs with several age bands indicating increased HODLing activity.

Bitcoin’s[BTC] liquid supply sank to new depths, raising concerns for investors looking to get their hands on the king coin. According to data from blockchain analytics firm Glassnode, the supply of BTC on trading platforms dropped to a 5-year low as of 15 July.

📉 #Bitcoin $BTC Balance on Exchanges just reached a 5-year low of 2,250,825.538 BTC

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/3CHoAvtyQY

— glassnode alerts (@glassnodealerts) July 15, 2023

Long-term investors stay away

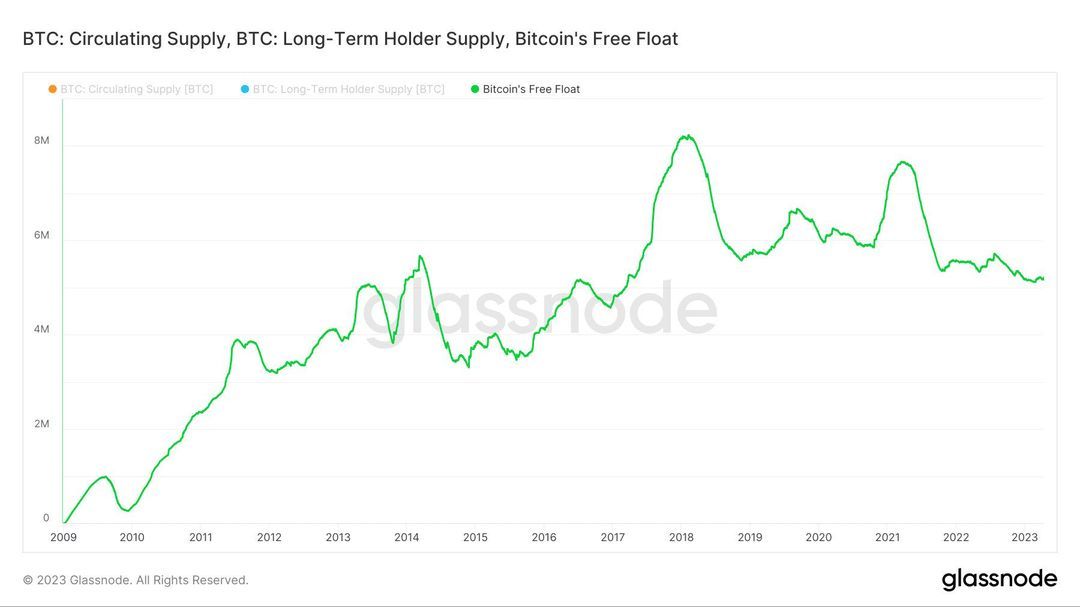

About 2.5 million BTC coins were present on centralized exchanges, equating to just 11.5% of the total circulating supply. From the peaks of March 2020, the exchange supply has progressively reduced, marking a decisive shift in sentiment from trading to HODLing.

Long-term holders of Bitcoin have shown less willingness to sell even as prices have recovered in 2023. According to data from CoinMarketCap, BTC has nearly doubled from its November 2022 lows until press time.

Despite this, diamond hands have refused to let go of their BTC holdings. Dormant supply has pushed to new highs with several age bands indicating increased HODLing activity.

Source: Glassnode

A primary reason behind this trend could be because most of these investors acquired the coins preceding the bear market of 2022, during which BTC prices touched new peaks. Compared to then, BTC hasn’t recouped significantly. It’s possible that this has led these seasoned traders to play the waiting game until the market regains bull momentum.

Bullish in the long term?

With the important halving event being less than a year away, investors are being drawn towards the bullish capabilities of BTC and are looking for opportunities to grab the king coin.

However, as the amount of BTC available for purchase continues to dip, these future buyers might have to pay significantly higher prices to persuade long-term holders to sell their holdings.

Source: Glassnode

Bitcoin has been locked in the $30,000-$31,000 range for several weeks, dampening high spirits following last month’s rally. The market sentiment, although, was shown to be in a state of ‘Greed,’ as per the latest reading of the Bitcoin Fear and Greed Index.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

5 comments