An overview of how the crypto industry fared in Q2 2023

The market was relatively quiet. However, a few developments with Ethereum, and introduction of Bitcoin NFTs lit up the space.

ETH staking grew but Bitcoin’s performance was much less than Q1.

Exchanges and NFT trading volume dropped.

The second quarter of the year witnessed significant developments and fluctuations across the cryptocurrency landscape. Unlike Q1, the April to June period came with diverse outcomes for Bitcoin [BTC], Ethereum [ETH], the NFT sector, and trading volumes on exchanges experiencing.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

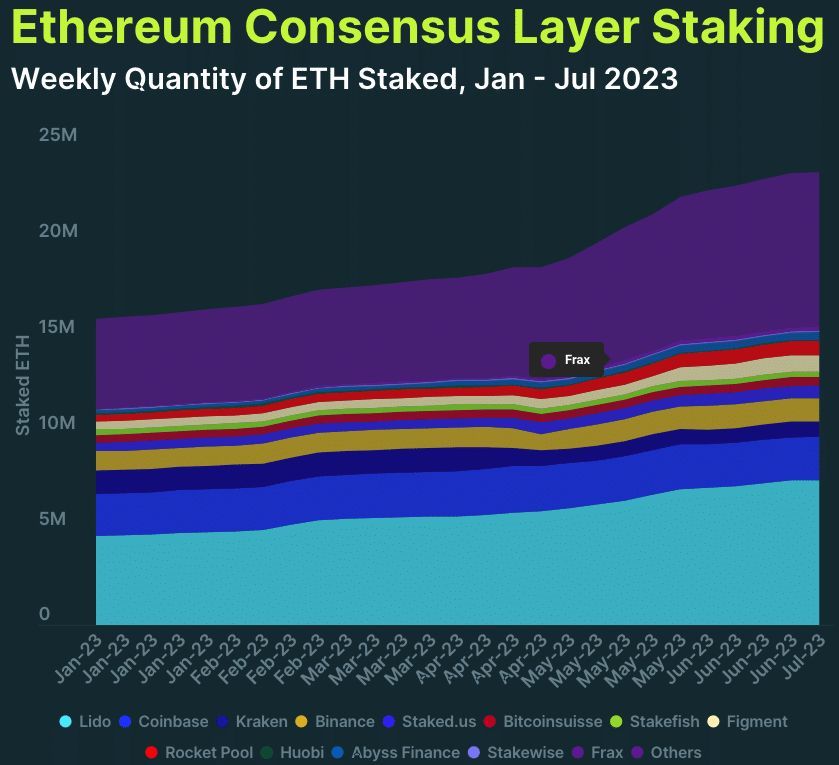

To begin with, one major event that happened at the start of the quarter was the Ethereum Shapella upgrade. And this was highlighted in CoinGecko’s crypto industry report. The upgrade, which was the first major upgrade on the blockchain after the Merge, happened on 12 April.

Staked Ether did not fall short

And this enabled validators to unstake the ETH deposited into the network if they desired. According to the CoinGecko report, ETH staking grew by 30.3% in Q2, with the usual suspect Lido Finance [LDO] dominating the staking provider standings.

However, the report did not fail to mention the decline in other staking providers— particularly exchanges. And the major reason for this was the regulatory issues Coinbase and Kraken faced with the U.S SEC. The report stated that,

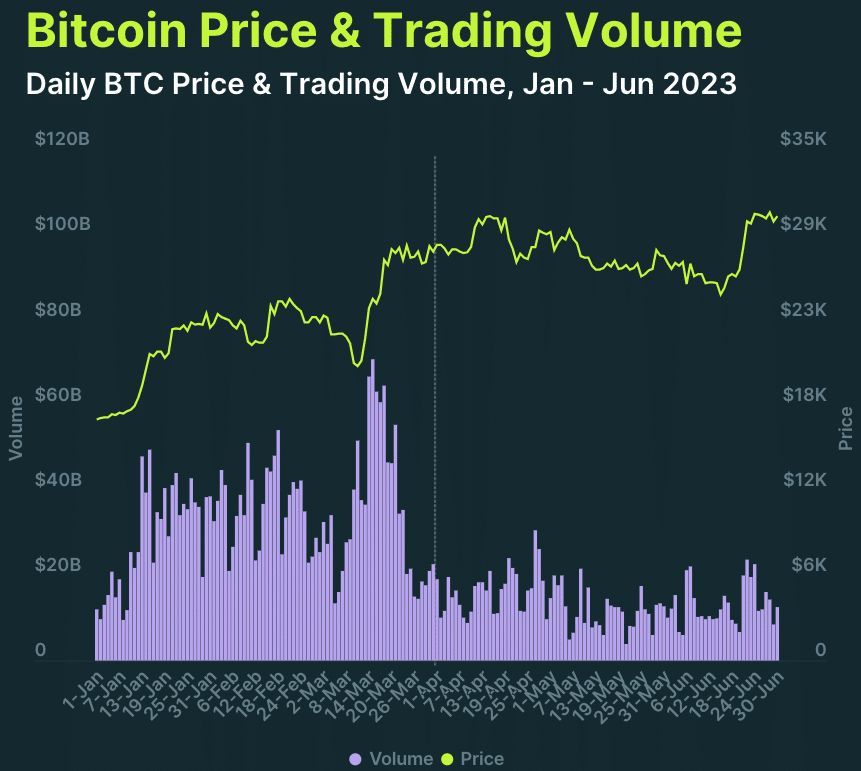

BTC steps back as exchange volume dropped

For Bitcoin, its tremendous growth in Q1 slightly cooled off. Despite hitting a Year-To-Date (YTD) high of $30,694, which drove the crypto market cap to $1.24 trillion, BTC only managed a 6.9% Quarter-on-Quarter (QoQ) increase.

While Bitcoin’s average daily trading volume dropped to $13.8 billion, stablecoins were also affected. The market cap of Binance USD [BUSD], and Circle [USDC] dropped. However, Tether [USDT] was able to sustain its top position.

There was also a noteworthy stablecoin in the spotlight — TrueUSD [TUSD], whose market cap grew by 50%.

9 comments