Cosmos dips beneath $9.4, can the bulls recover?

The rejection from $10 for Cosmos combined with Bitcoin’s reluctance to climb back above $30.8k suggested that bulls could lose their grip on the market upon a price drop below $9.1.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Despite a lower timeframe edge in favor of ATOM bulls, some factors showed bears could reclaim the driving seat.

The $10-$10.6 region was a higher timeframe resistance that swing traders could watch out for.

Cosmos [ATOM] prices retested the $8.43 level as support on 15 June. This had been a higher timeframe support level that ATOM bulls had been unable to defend in the selling wave of 10 June. This development sparked a rally that has not yet been halted, with ATOM gaining 22% before the rejection from $10.

Read Cosmos’ [ATOM] Price Prediction 2023-24

At the time of writing, Bitcoin [BTC] traded below the $30.8k mark, marking the threat of bears taking control of the market at any moment. Yet, the bulls were not out of the picture either.

ATOM saw a break of structure but a rebound was likely

The recent higher low at $9.34 was broken on 5 July, highlighted by the green line. Although this signified a bearish market structure break, it was an aggressive reading of the Cosmos market. The $9.1-$9.4 has been a region of intense resistance since 21 June and was only recently flipped to support. The trend on the 4-hour chart has also been bullish in the past two weeks.

The RSI dropped below neutral 50 to signify a shift in momentum toward the ATOM sellers. The OBV also saw a pullback but retained its uptrend from 12 June. Everything put together, it was uncertain that the bears could seize control. However, with BTC below the $31k mark, a price move above $10 could be difficult in the coming days.

While ATOM bulls can look to buy the asset, they must be aware that the market sentiment could go either way. Neither bulls nor bears were dominant in the short-term but the bulls have the edge. A drop below $9.1 would indicate ATOM traders can look for short positions instead.

The $10.2-$10.6 represented a bearish order block on the 1-day timeframe. Hence, swing traders can look to book profits here, and buy upon a move above $10.6.

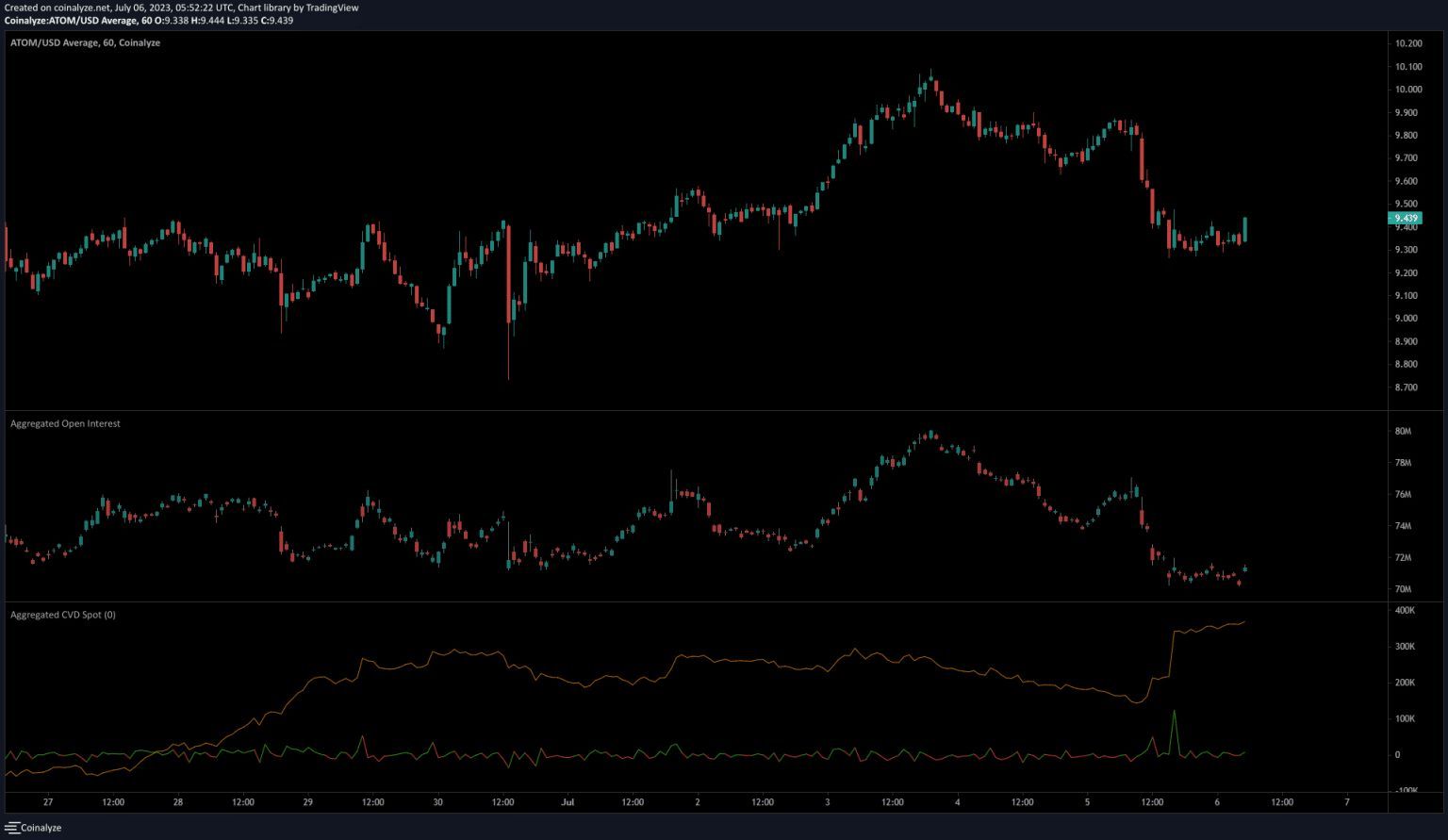

The spot CVD saw a positive slope to indicate accumulation during the price drop

Over the past two days, the price of Cosmos and the Open Interest have declined. This showed discouraged longs and highlighted bearish sentiment in the market. However, it was the 1-hour timeframe chart. Hence the near-term sentiment could shift bullish upon a bounce from the support zone at $9.4.

To support this idea, the spot CVD saw a large spike in recent hours. Its positive slope during the price drop suggested buyers were accumulating during the pullback. Hence although conditions remain uncertain the bulls do have the upper hand in the near term

14 comments