Chainlink price falls 5% as LINK airdrop starts, available for Ethereum Layer-2 users

Chainlink has rolled outs its much-anticipated airdrop, with distribution based on on-chain activity.

Up to $20 million has been allocated for the airdrop, which is available for qualified L2 Ethereum users.

LINK price has succumbed to selling pressure, falling 5% as airdrop holders look to dump

Chainlink price drops as $20 million airdrop commences

Chainlink (LINK) price has shed approximately 5% of its value, moving from the $6.318 intra-day high recorded on Tuesday. The slump can be attributed to the network’s $20 million airdrop, which has inspired a sell off among airdrop token holders.

Finally! Chainlink JUST released INSANE Airdrop which almost ANYONE can get! This is how https://t.co/9XFQS48VGf Chainlink is open-source technology that is collectively developed by a large community of developers, researchers, and users who share the goal of building…

— 周婷婷 (@mico_tin631002) August 30, 2023

The airdrop is available for Ethereum Layer-2 (L2) users that meet the requirements. It is a means for the network to reward the LINK community, while at the same time incentivizing participation in the network.

Chainlink has earned its place among the go-to networks for decentralized finance (DeFi) developers and projects. The popularity attributes to its unique ability to link smart contracts to off-chain data sources. The airdrop is timely, coming at a time when the market is craving volatility. With traders looking for actionable price moves for a quick profit amid a lull market, the sell-off provides futures traders an avenue for profit.

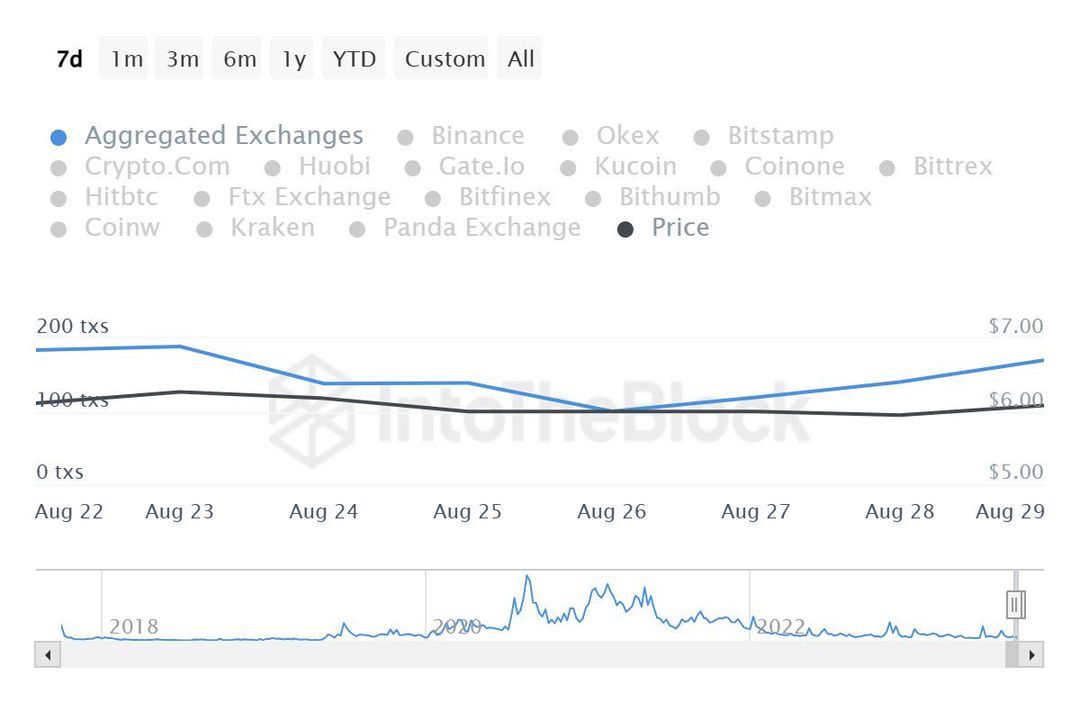

Data from IntoTheBlock shows that inflows into exchanges have been on a steady rise since August 26, suggesting intention to sell as investors sought to avoid the value drop.

LINK inflows into exchanges

LINK price forecast amid increasing selling pressure

At the time of writing, Chainlink price is at $5.907 while working out the next move. Momentum indicators such as the Relative Strength Index (RSI) and the Awesome Oscillator favor the downside, meaning LINK could continue south, potentially losing the $5.808 support level before dipping into the demand zone at $5.407.

Considering a demand zone is characterized by aggressive buying, Chainlink price could bounce from this order block. However, if it fails to hold as a support level, the altcoin could break below the support floor at $5.020.

LINK/USDT 1-day chart

Conversely, investors leveraging the slump to buy the dip could send Chainlink price north, possibly clearing the $6.609 barricade for a chance to test the supply zone at $7.103. LINK could also correct around this zone, where aggressive sellers abound. However, if it fails to hold as a resistance level, an extension north could ensure, confirmed by a decisive daily candlestick close above $7.637.

In a highly bullish case, Chainlink price may extrapolate to the $8.144 supplier congestion zone, levels last seen in late July. This would indicate a 5% ascension against what would then be a bullish breaker.

8 comments