AnchorWatch Bitcoin Insurance Raises $3 Million To Expand Products For Users

AnchorWatch, a leading commercial entity insurance company specializing in Bitcoin custody, has successfully raised $3 million in a recent financing round spearheaded by Ten31.

AnchorWatch Bitcoin Insurance Secures Investment for Innovative Bitcoin Custody

The round also saw participation from Axiom BTC, Timechain, the Bitcoin Opportunity Fund, and UTXO Management. This significant investment will enable AnchorWatch to fulfill regulatory and capital prerequisites, bringing its revolutionary Trident Vault Bitcoin custody solution to market.

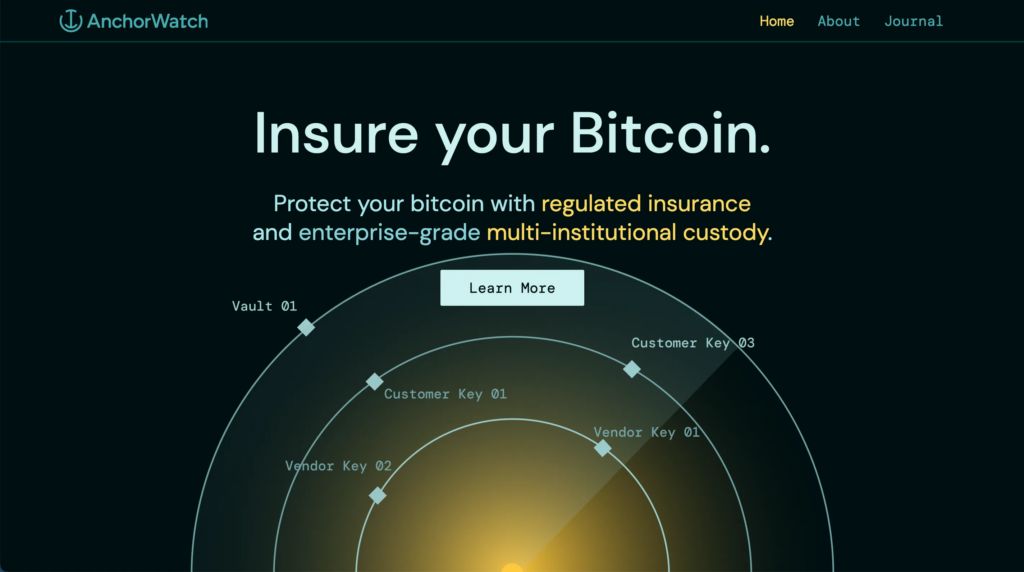

AnchorWatch Bitcoin insurance’s proprietary Trident Vault software is designed explicitly for commercial use, introducing novel features such as key holder seniority and time-locked spending conditions for institutional Bitcoin custody.

The Trident Vault employs a layered security approach, distributing custody physically and among unrelated entities. This safeguards against potential loss from unforeseen events like fires, floods, or internal and external theft.

Redefining Bitcoin Custody with Enhanced Security

One distinctive aspect of Trident Vault is its integration of regulated property insurance directly within the Bitcoin custody solution, ensuring assets are protected in catastrophic scenarios through regulated and collateralized property insurance. This enhanced security enables AnchorWatch Bitcoin insurance to offer insurance at competitive rates.

With this fresh injection of funds, AnchorWatch is well-positioned to complete the necessary regulatory and capital milestones, paving the way for Trident Vault’s launch and policy sales and delivering a game-changing solution for Bitcoin custody in the commercial sector.

2 comments