Is Fidelity’s Bitcoin ETF the catalyst BTC needs?

Fidelity, a massive fund, joins the Bitcoin ETF party by re-applying for an ETF. Institutional interest in BTC attracts holders, causing prices to rise.

Fidelity re-applied for Bitcoin ETF, suggesting a shift in market sentiment.

The price and number of holders rose as miners faced selling pressure.

Over the last month, many funds such as BlackRock have showcased interest in Bitcoin [BTC] by filing for Spot ETFs, which have generated massive bullish sentiment for the king coin.

Putting the ‘Fun’ in Funds

For context, ETFs are investment vehicles that aim to provide investors with an accessible and regulated way to gain exposure to the asset in question. These ETFs track prices and allow investors to buy and sell shares on traditional stock exchanges.

Their approval would bring significant benefits to Bitcoin and the broader market.

However, other funds apart from BlackRock have also started showing interest in Bitcoin. Fidelity, a large asset management firm, recently refiled its proposal for a BTC ETF. In 2021, Fidelity had initially applied to the U.S. SEC to launch the Wise Origin Bitcoin Trust.

However, the SEC rejected this endeavor in 2022.

This refiling suggests that the legislative and governing bodies may have started looking kindly towards the king coin and related financial instruments. Moreover, Bitcoin ETFs, trading on regulated exchanges, would provide a seamless and convenient way for investors to enter and exit their positions.

This increased liquidity can help mitigate price volatility, narrow bid-ask spreads, and improve overall market stability.

How is Bitcoin doing?

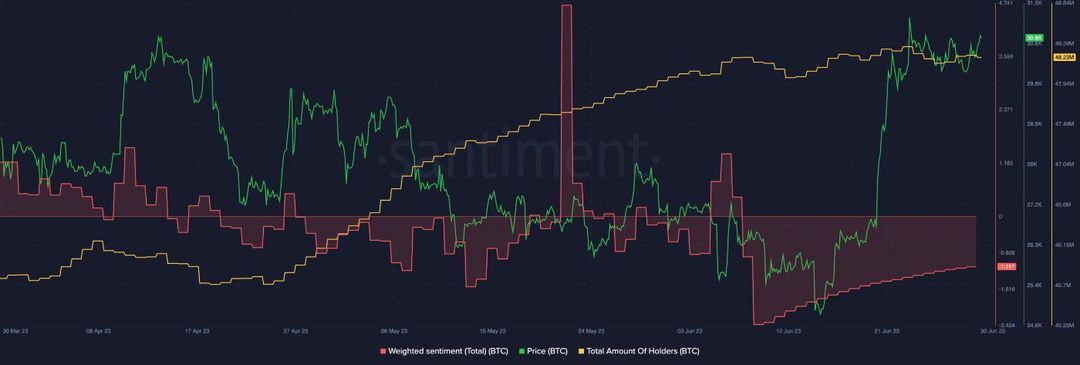

At press time, BTC was trading at $30,800. Its price had appreciated significantly over the last few days. In tandem with its growing price, the overall number of holders of Bitcoin also increased.

However, despite all these positive developments, it was seen that weighted sentiment remained negative. This indicated that the number of negative comments for Bitcoin on the social front outweighed the number of positive comments.

Source: Santiment

This decline in sentiment could be a cause of concern for holders. Another factor that could impact BTC negatively would be the growing selling pressure on miners. Recent data indicated that miners were sending record amounts of the king coin to exchanges.

5 comments