Bitcoin Price Prediction as K33 Research Analyst Says 'Multiple Positive Catalysts Ahead' – Can BTC Reach $100,000 This Year?

Bitcoin's current trading pattern has been characterized by choppiness, as it maintains a narrow trading range between $29,000 and $31,350.

As the crypto market continues to capture the attention of investors and enthusiasts, the question on everyone's mind is: Can Bitcoin reach $100,000 this year?

According to K33 Research Analyst, multiple positive catalysts lie ahead, fueling optimism and speculation about the potential for a significant surge in Bitcoin's price.

In this Bitcoin price prediction, we delve into the analysis and predictions surrounding Bitcoin's future and explore the factors that could drive it toward the coveted $100,000 milestone.

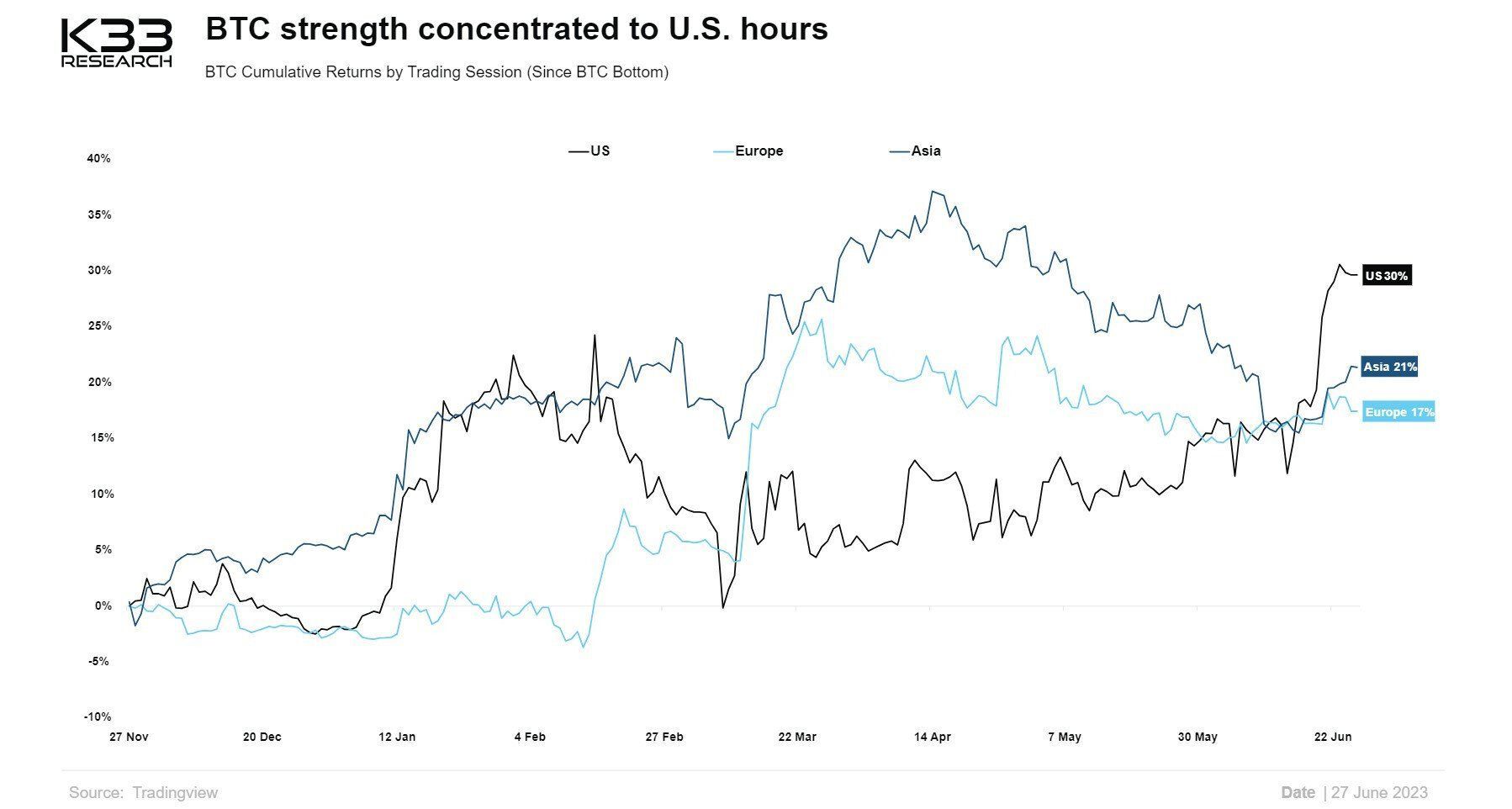

K33 Research Analyst Bullish on Bitcoin as Summer Season Offers Prime Accumulation Opportunity

Bitcoin's price is expected to benefit from a positive outlook as K33 Research analyst Vetle Lunde highlights the summer as a prime accumulation period.

With Bitcoin currently trading above $30,000, Lunde expresses growing optimism fueled by multiple positive catalysts on the horizon.

Lunde emphasizes the resurgence of institutional interest in spot Bitcoin ETFs, signaling a validation of Bitcoin as a viable and sound investment alternative.

This institutional support, combined with other factors, sets the stage for an exciting market in the coming nine months, potentially impacting the price of BTC significantly.

Bitcoin Price Prediction

Bitcoin made unsuccessful attempts to surpass the $31,000 resistance level and underwent a downward correction below $30,850.

The breach of a bullish trend line with support at approximately $30,750 resulted in a drop below $30,250, with a low near $30,160.

At present, Bitcoin is consolidating its losses and trading near the 23.6% Fibonacci retracement level. It remains below both $30,800 and the 50-days Simple Moving Average.

Bitcoin Price Chart - Source: Tradingview

Immediate resistance is evident around $30,600, followed by a significant resistance level near $30,750 and the 50-day Simple Moving Average.

To retest $31,000, the price would need to surpass the 50% Fibonacci retracement level.

Conversely, if the $31,750 resistance level remains unbroken, Bitcoin's downward movement may continue. Immediate support lies around $30,150 and the recent low, while the next major support level is near $30,000.

Further losses could potentially drive the price towards $29,550 or even the $29,200 zone in subsequent sessions.

8 comments