Will SOL change its direction in light of this update on Solana’s DeFi front

Solana witnesses a massive uptick in DeFi acivity due to its Liquid Staking Derivative. However, SOL’s price continues to deline.

Solana’s liquid staking protocol proves to be beneficial for the network in the DeFi sector.

The number of developers is on the rise as the ecosystem begins to thrive; SOL witnesses a minor correction.

Over the last few months, Solana [SOL] observed massive volatility. This impacted the ecosystem it was a part of and its price. However, the recent popularity of its DeFi sector could affect the protocol positively in the future.

Solana dips into Liquid Staking

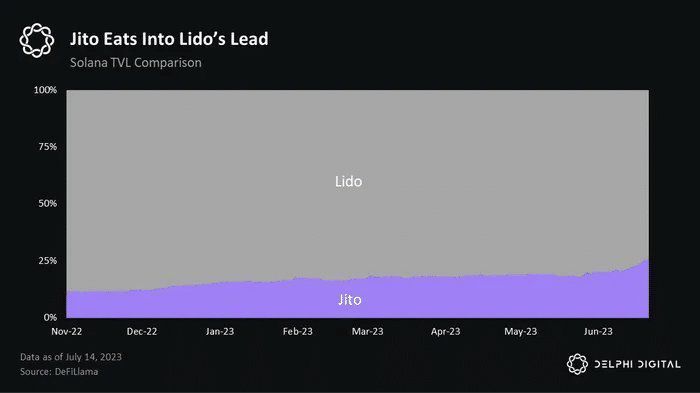

Based on data from Delphi Digital, the rise of Solana DeFi has been notable following the FTX debacle. During this period, the community showed strong support for Solana-first protocols like Jito, which stands as Solana’s first MEV-powered liquid staking derivative.

Jito’s token brings forth positive yield opportunities while concurrently enhancing Solana’s decentralization and fortifying the security of its network. Delphi Digital’s data indicated that the Jito protocol was eating into Lido’s market share at press time.

Source: Delphi Digital

The popularity of Solana’s dApps may not only improve the state of the ecosystem but also attract new users to the platform.

Solana has emerged as one of the most scalable blockchains, exhibiting a remarkable capacity to process up to 65,000 transactions per second (TPS). With the issues surrounding FTX now resolved, the ecosystem and community utilized this period to reevaluate and focus on development. Furthermore, the price of SOL experienced a substantial increase of over 200% year to date.

Additionally, there has been a positive surge in the number of developers deploying smart contracts on the Solana blockchain. This update highlighted the potential emergence of a promising future for the protocol.

Source: token terminal

State of SOL

At press time, SOL was trading at $23.81. Since 10 June, there was an 83.14% appreciation in the price of SOL, marked by several higher highs and higher lows, indicative of a bullish trend.

However, after testing the support level at $32.33, SOL experienced a subsequent price decline. Despite the significant fall, it was not sufficient to establish a bearish trend conclusively.

However, the Relative Strength Index (RSI) suggested that the momentum was on the side of the sellers at the time of writing. The Chaikin Money Flow (CMF) also implied that the money flow showcased a bearish outcome for SOL.

Source: Trading View

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

5 comments