Avalanche bulls hesitate near $14 because…

AVAX was yet to reclaim the March low of $14. Buying volumes in the futures market dipped.

Since 20 June, Avalanche [AVAX] bulls gained ground, recording 20% after rising from $11 to $13.7. However, the recovery faltered below the March low of $14, setting in a short pullback that threatens to claw back recent gains.

Meanwhile, Bitcoin [BTC] was facing a major tussle between bulls and bears over the control of $30k. So far, bulls have kept BTC above $30k, but bears haven’t allowed them to retest $31k or the recent high of $31.4k, setting it to a price consolidation.

Bulls get cold feet near $14

Source: AVAX/USDT on TradingView

In Q2 alone, AVAX dropped from its April high of $21.56 to $10 in mid-June, shedding over half of its value. With an extending BTC price consolidation below $31k, a reclaim of the 14 March show AVAX’s bullish strength.

The RSI has retreated to 50-mark, showing eased buying pressure. However, the bulls could attempt to rebound if RSI makes a U-turn at the neutral mark. Similarly, the OBV (On Balance Volume) had a slight uptick, indicating little demand in the past few days.

So, sellers could extend gains to $12.11 if the short-term support of $12.64 cracks, exposing AVAX to further weakening. But bulls could defend the recent lower high of $12.11; hence sellers could exercise caution at the support level.

On the flip side, AVAX could see further gains if bulls reclaim the March low of $14. The level was a key support in late May/early June. Such a move could make extra gains at $15.0 or $15.9 feasible.

Buying volumes eased

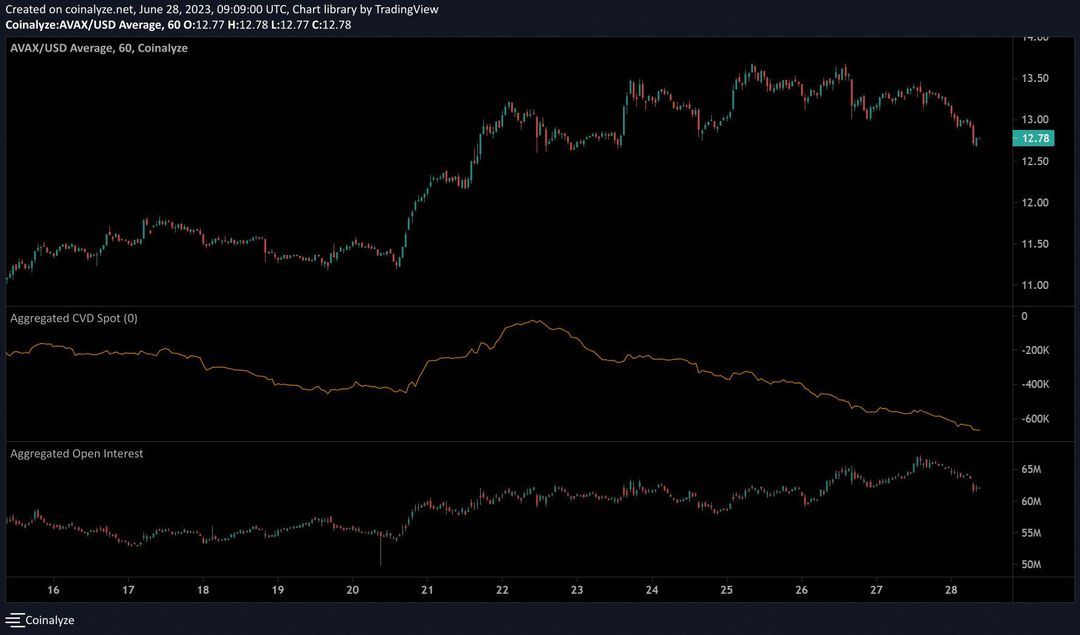

Source: Coinalyze

On the 1-hour chart, the buying volumes surged sharply around 20 June, as shown by the rising CVD (Cumulative Volume Delta), and coincided with BTC’s upswing. However, the metric declined later, edging lower and lower at the time of writing. It shows buying volumes eased in the futures market.

Interestingly, the Open Interest (OI) remained positive between 20 – 27 June. But it declined after that, dropping from >$66 million to around $61 million at the press time.

Taken together with BTC fluctuations, a bearish sentiment could prevail unless the king coin gives a clear direction. A $12.64 or $12.11 retest could offer buying opportunities if BTC doesn’t record massive losses.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

4 comments