Time horizon in investing

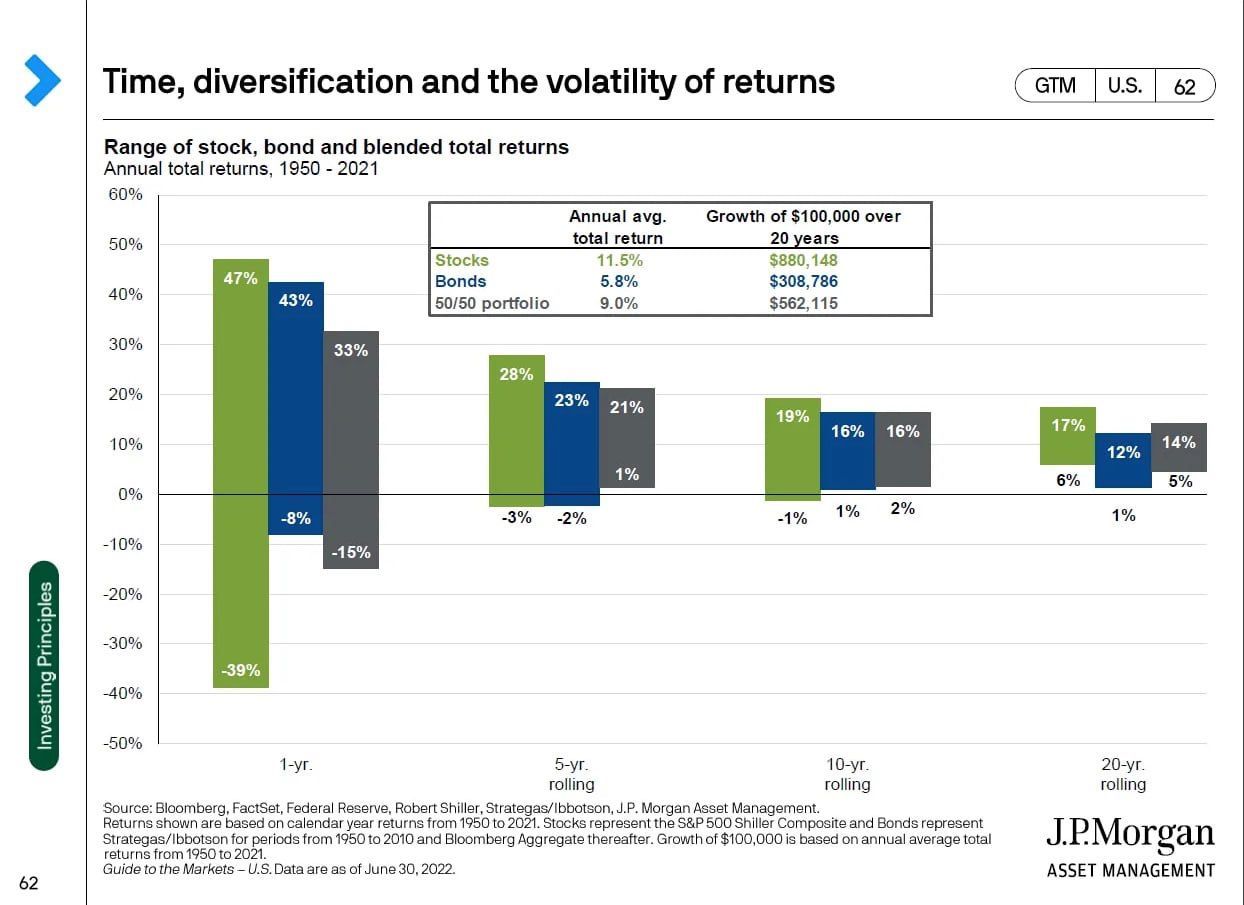

Interesting statistics from JP Morgan — Return on investment (ETF) depending on the time horizon.

Let’s compare!

By the way, the Crypto Market also has a classic ETF — C100.

We will be comparing crypto as a class with stocks of American companies — green bar from JP Morgan.

On a horizon of 1 year — the spread of returns is impressive: from -39% to +47%.

To lose 40% in a year — crazy?

By 5 years of «hodling the asset» the spread is from -2% to +28%. There is almost no chance of losing on that horizon.

And by 20 years is only positive return.

It is obvious — longer you are in the market, less likely you are to lose money while investing in it.

For crypto a long holding horizon works just fine too.

If an investor went into C100 in 2017 and holds the asset now, even with two crypto winters, the return is over 10,000%

Of course you have to be prepared for dips on such a volatile asset class.

If yields are in the thousands %, then the dip will hurt.

In May alone, the market was down 40% (almost the maximum annual dip in stocks).

But the returns are great — 2021 brought investors +500% in a year.

The conclusion is simple — in short (1 year) intervals the probability that something goes wrong in passive strategy is high.

You should not go in for a month or a year. But at least for 5 years.

The average annual return on the stock market if you hold an ETF for 20 years is 11%, and it turns $100k during that time into almost $1M

But who wants to get rich slowly, right?

Crypto is a younger asset class and its more volatile. Does it mean you’ll have to wait less?

44 comments