Bitcoin gets leg-up from Chinese liquidity: Here’s why this is important

China’s central bank has been using open market operations to pump more funds into the financial system. This may have encouraged more Chinese investors to acquire more Bitcoin.

Bitcoin’s latest upside received a confidence boost from the East.

Sell pressure remains at bay despite Bitcoin dipping into overbought territory.

A few weeks ago we looked into China’s decision to soften its stance on Bitcoin [BTC] and the overall crypto market. The effects of that decision were now evident in BTC’s latest performance.

Recent data suggested that China has been increasingly contributing to the level of liquidity flowing into BTC. Multiple factors have contributed to this observation. For example, the latest PMI data revealed that China’s manufacturing sector shrunk in April. As a result, investors shifted their attention elsewhere, thus BTC benefited.

The data also showed that China’s central bank has been using open market operations to pump more funds into the financial system. This may have encouraged more Chinese investors to acquire more BTC.

Furthermore, China’s short-term lending rate recently fell to a 10-month low, hence encouraging more borrowing. Some of the cheap borrowed liquidity may have found its way into BTC.

Will the bears continue quenching their thirst on Chinese liquidity?

A scenario in which China suddenly raises lending rates would disfavor BTC. Perhaps even force some to sell. Such an outcome would likely have a bearish impact on BTC. Away from that, investors should be taking note on the fact that China is currently among the markets contributing heavily to the recent BTC demand and rally.

BTC’s on-chain characteristics can also teach us a few things about its current position and prevailing demand. BTC’s mean coin age metric was seen rising at the time of writing despite periods YTD.

Source: CryptoQuant

Furthermore, BTC’s dormancy embarked on some downside in the last few days, since 23 June. It was also notably lower than it was at the end of May. This reflected the sell pressure observed at the end of May, as traders took profit. Interestingly, BTC’s $30,580 press time price was now at the previous YTD peak in April.

Source: TradingView

Can the Chinese liquidity help push prices to new YTD highs? This Asian liquidity has certainly contributed to the recent bullish momentum and might perhaps support the recent highs. But, traders should contemplate the fact that BTC recently popped into overbought territory last week. Thus sell pressure expectations are notably higher.

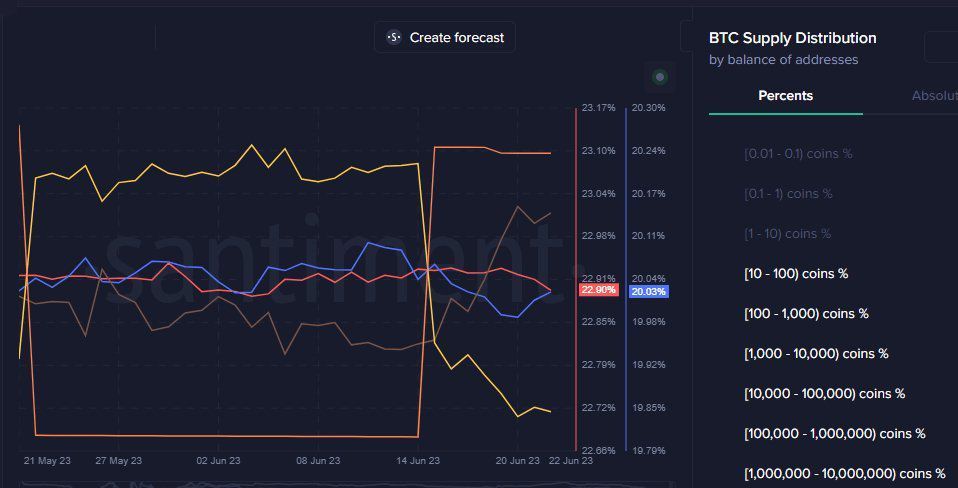

Additionally, BTC’s supply distribution revealed something interesting about the current state of the market. Whales weren’t contributing as much to sell pressure as one would expect especially after being overbought.

Source: Santiment

The above findings indicated that there was still some confidence in BTC’s potential upside. Especially now that demand from the East has been on the rise.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

8 comments