Stablecoins Suffer 18-Month Decline, Regulatory Uncertainty at the Helm

Stablecoins have endured an 18-month-long decline, with their market cap shrinking by 35% since May 2022, as reported by DefiLlama. During this period, the sector has had to deal with increased regulatory uncertainty and scrutiny from regulators globally.

In September, CCData, a crypto research firm, reported a 28.4% decrease in stablecoin trading volume on centralized exchanges, amounting to $331 billion. This marked the lowest monthly total since July 2020.

The Decline’s Underlying Factors

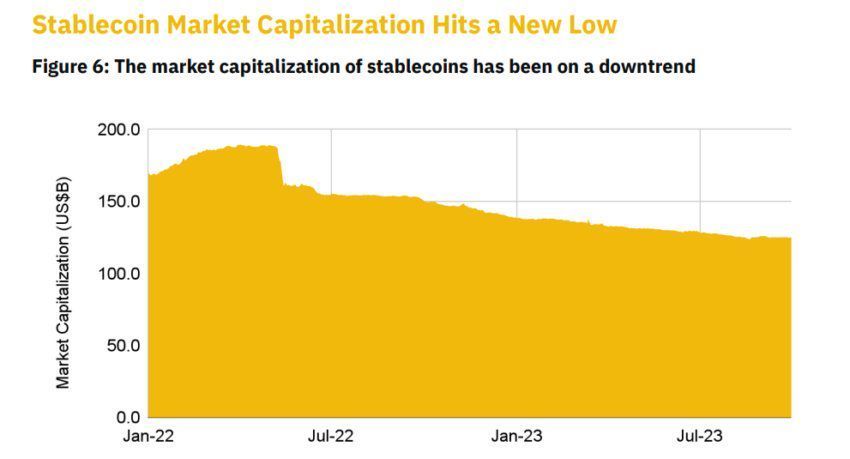

The collapse of TerraUSD is a key contributor to the 35% decline in the overall market cap of stablecoins. After reaching a peak of $189 billion in May 2022, the market cap currently rests at approximately $124 billion.

Stablecoin Market Cap Decline. Source: Binance Research

Many experts within the industry point to regulatory uncertainties as a significant factor impeding the growth of these assets. Last month, Binance wrote that it could be forced to delist multiple stablecoins in Europe because of the impending Markets in Crypto Assets (MiCA) regulations slated for next year.

According to the exchange, none of the stablecoins in the market currently meet the required EMI licenses for their operations in the region.

Additionally, lawmakers in several jurisdictions, including the U.S. and Hong Kong, are working on regulations to guide the industry. Market observers believe these regulatory efforts will suppress the stablecoin market and have played a substantial role in this downward trend.

However, Binance Research stated that stablecoins still play a fundamental role in the crypto ecosystem despite falling market capitalization.

USDT Remains Dominant

Despite the broader decline in the stablecoin market, USDT remains the dominant player in the sector. USDT’s market cap is $83.54 billion, three times higher than its closest rival, USDC, which stands at $25.017 billion. This firmly establishes USDT’s dominance, with a market share of about 67.3%, according to DeFillama data.

On October 6, Tether’s USDT celebrated its ninth anniversary, with CTO Paolo Ardoino describing it as a technology revolutionizing finance. Ardoino further highlighted the importance of these assets, saying, “central banks are looking at stablecoins as the future of their digital money (CBDCs).”

1 comment