Azuki ‘Elementals’ Mint Mishap Highlights the Fragile State of the NFT Market

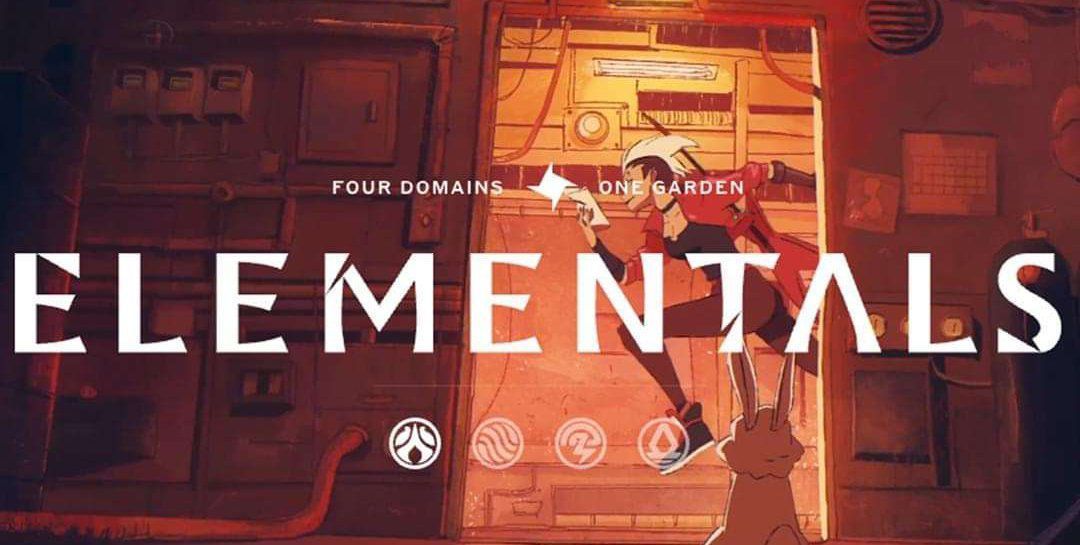

On Tuesday, non-fungible token (NFT) brand Azuki opened up sales for its new “Elementals” NFT collection, a 20,000-edition derivative of its wildly-popular, original Azuki collection. The new release was teased to major fanfare, as passionate holders waited for the latest expansion of the anime-inspired Azuki ecosystem.

Collectors have held their breath – and their bags – waiting for signs of growth from Azuki, which teased ambitious plans for a metaverse platform, interactive experiences, physical goods and a native token earlier this year. And while the project has released collaborations with fashion brand Ambush and an impressive but impractical NFT-backed golden skateboard, its last major expansion to its character universe came from the release of its BEANZ collection in March 2022. Azuki has also faced some major challenges in recent months, including a hack on its Twitter account and an admission from its founder that he had abandoned past projects, rocking confidence in the project.

Still, Azuki has largely remained at the top of the NFT leaderboard since it launched in January 2022, despite market conditions that have worsened over time. According to data from secondary marketplace OpenSea, the project has raked in 588,674 ETH or just over $1 billion, in trading volume. BEANZ has also provided major cash to Chiru Labs, the parent company behind Azuki. According to OpenSea, the project has brought in 166,373 ETH, or about $304 million, in trading volume.

To maintain momentum, the team needed a major win.

Enter Azuki “Elementals,” which NFT holders hoped would reinforce the project’s foundations and propel the brand forward. But despite best efforts, the mint was tainted with technical issues, questionable mint mechanics and allegedly duplicated artwork that sunk the Azuki and BEANZ floor prices. At the time of writing, the floor price for Elementals NFTs was hovering around 1.5 ETH (about $2,700) on OpenSea, falling below its original mint price of 2 ETH in just over 24 hours – meaning that holders were selling at a loss.

Considering Azuki’s dominance, the latest mint mishap has broader implications for the NFT market and highlights how even blue-chip NFT projects are struggling to grow during a particularly challenging bear market.

7 comments