Russian rouble rises after geopolitics-led rout; EM stocks slide

Jan 14 (Reuters) - Russia's rouble firmed 1% and bonds held steady on Friday in volatile trading amid heightened geopolitical tensions, while broader emerging markets stocks fell on hawkish comments from U.S. Federal Reserve.

Fed policymakers opened the door to a March interest rate hike as well as four hikes this year, as opposed to three that markets had priced.

Emerging market assets, which lose their high yield appeal when U.S. interest rates rise, slipped, with MSCI's index of emerging shares (.MSCIEF) losing 0.4%. China stocks were dragged by property stocks.

But the world's most indebted developer China Evergrande Group (3333.HK), with $300 billion in liabilities, rose 0.6% after it secured an extension for redemption and coupon payments of a $4.5 billion yuan bond.

For the week, the broader emerging stocks index was set for its best performance since September, as Fed Chair Jerome Powell and in-line U.S. inflation data earlier in the week had temporarily tempered hawkish bets.

This also resulted in weekly gains of about 2% for currencies of South Africa and Turkey .

Turkey Finance Minister Nureddin Nebati was cited as saying inflation would peak in January and start to fall from May, reaching single digits by June 2023 when elections are scheduled. Data on Thursday showed net FX reserves dropped again to their lowest in two decades.

WAR RUMBLINGS

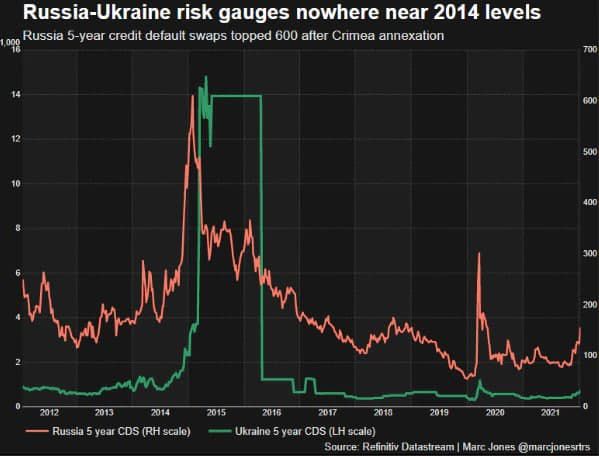

A marathon of talks between the Kremlin and the West this week laid bare the big divisions and stoked fears of armed conflict. German Foreign Minister Annalena Baerbock said she will travel to Moscow next week for talks as Russian troops still line the Ukraine border.

Russian and Ukraine dollar bonds , stayed at April 2021 and 2020 lows, respectively, while Moscow-listed stocks (.IMOEX) extended losses after Thursday's 4% slide.

"Russian and Ukraine assets will remain vulnerable to newsflow over coming weeks, but any signs of compromise - or at least commitment to talks at a future date - could see an outsized rally in the rouble and a reversal of this week's sell-off in Ukraine fixed-income assets," said Chris Turner, global head of markets at ING.

The Ukrainian hryvnia was steady at near nine-month lows against the dollar. The rouble looked to trade back at 75 after slipping to 76.57 a greenback on Thursday.

A massive cyberattack warning Ukrainians to "be afraid and expect the worst" hit government websites on Thursday night, leaving some websites inaccessible on Friday morning and prompting Ukraine to open an investigation.

1 comment