Miners metrics group

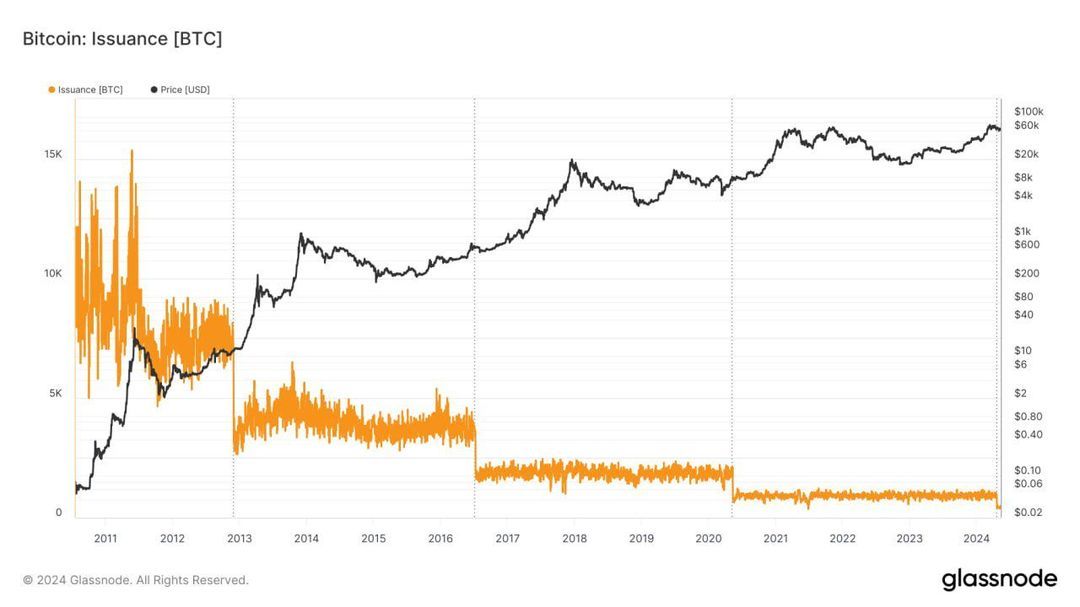

1️⃣ Issuance

Reflects the number of new BTC coins mined each day (orange color). The graph is somewhat inconsistent due to the natural variability in the network’s hashrate and the number of blocks mined per day (and thus the number of coins). Halving events, marked by dotted vertical lines, occur every 210,000 blocks, roughly every 4 years, reducing the number of BTC mined per block.

Current situation: Following the fourth halving on April 20, 2024, issuance has decreased as expected.

Rating: 10/10 in favor of buyers.

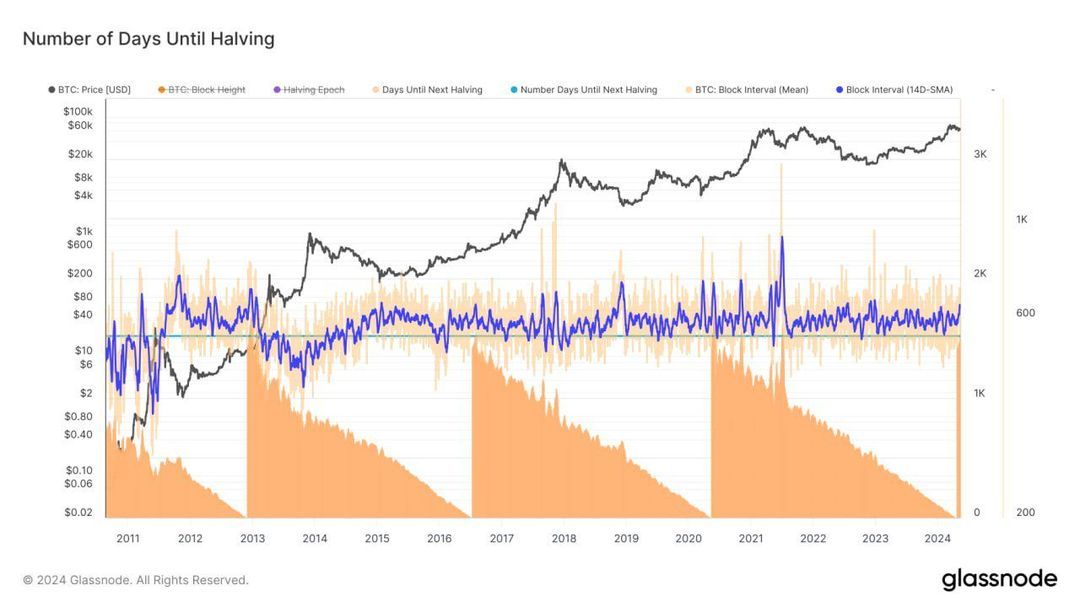

2️⃣ Number of Days Until Halving

Estimates the time remaining until the next Bitcoin halving.

Current situation: The fourth halving occurred on April 20, 2024. As of May 10, 2024, the metric shows 1532 days until the next halving, according to Glassnode (data still in calibration).

Rating: Informative metric, not directly rated.

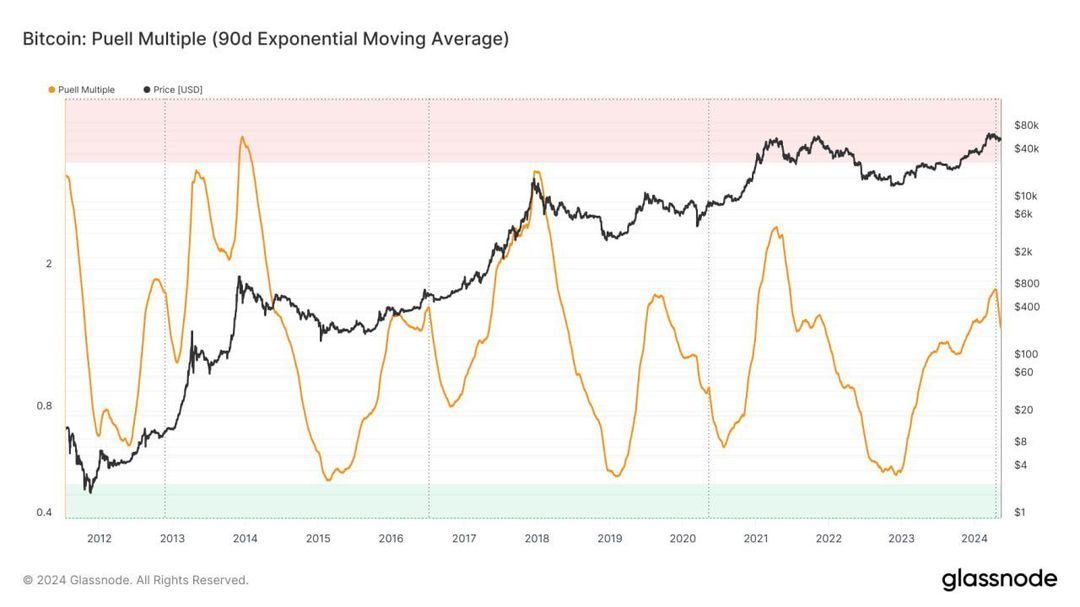

3️⃣ Puell Multiple

A cyclical oscillator that captures the overall behavior of the mining market. Calculated by dividing the daily issuance value of Bitcoins (in USD) by the 365-day moving average of the daily issuance.

Components:

Daily total miner revenue in USD.

Annual average miner revenue over 365 days.

Current situation: As of May 10, 2024, the Puell Multiple (90d) reached 1.38, indicating that the current daily revenue is slightly above the annual average, suggesting that the mining market is stabilizing post-halving.

Rating: 7/10 in favor of buyers.

4️⃣ Miner Net Position Change

Indicates the net change in BTC held by miners' addresses, providing insights into their selling or holding behavior.

Current situation: Since November 21, 2023, miners have primarily been selling BTC, increasing selling pressure until March 30, 2024. Recently, the metric shows a decline in selling pressure, indicating that fewer BTC are being moved from miners' addresses, reducing their impact on the market.

Rating: 6/10 in favor of buyers.

Total Miners metrics group rating: 7.7/10 in favor of buyers.

The Miners metrics group highlights significant changes due to the recent halving event.

The Issuance metric reflects the expected decrease in new BTC mined daily post-halving, signaling a supply reduction.

The Puell Multiple indicates that the current daily miner revenue is stabilizing slightly above the annual average, suggesting a normalization in the mining market post-halving.

The Miner Net Position Change metric shows a recent decrease in selling pressure from miners, indicating reduced impact on BTC price. Overall, these metrics suggest a positive outlook for Bitcoin, with continued support from the mining sector amidst the global upward trend.

9 comments