What are reflection tokens and how do they work?

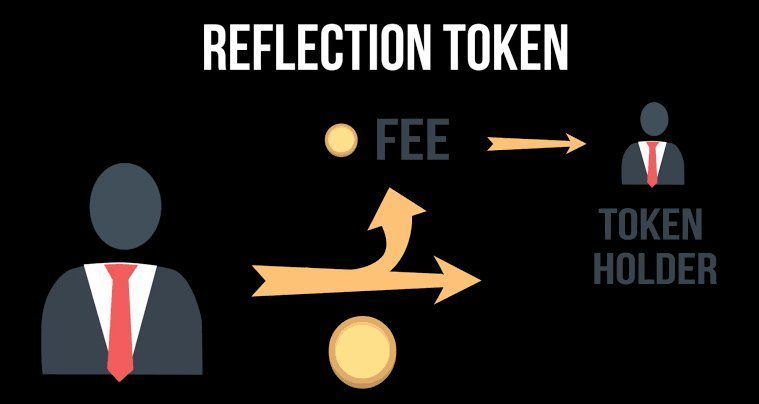

Reflection tokens allow holders to earn passive returns from transaction fees by simply holding onto their assets.

Yield farming, liquidity mining, and staking have become common practices in the crypto market due to the remarkable growth the DeFi ecosystem has witnessed in recent years. These features enable users to earn interest on their crypto holdings by locking them as deposits for specific periods.

The concepts sound appealing but there's one big risk: the potential decline in the valuation of the locked assets. In other words, users will see losses in U.S. dollar terms if the asset's value drops during the lock-in period.

These shortcomings have raised "reflection tokens" as a viable alternative. In theory, reflection tokenomics remove the necessity of locking tokens while still offering staking-like benefits.

2 comments