Bitcoin bulls have one last hurdle before $35k. A recent report highlighted the growing accumulation among Bitcoin sharks but distribution among miners.

The market was riding a wave of disbelief higher, and Bitcoin’s sally past $30.8k could open the bullish floodgates. A retracement back toward $28k could offer a buying opportunity.

Bitcoin [BTC] did not see a retracement beneath the $29k mark over the past two days. Instead, the bulls could defend the $29.6k level, as at the time of writing, BTC was trading at $30.7k.

A recent report highlighted the growing accumulation among Bitcoin sharks, but BTC miners and whales aided the distribution of the king coin. Despite market sentiment in recent weeks, demand and prices continued to grow, and could catch long-term bears offside.

The price is at a vital resistance once more, but a breakout was likely.

Source: BTC/USDT on TradingView

The daily timeframe bias for Bitcoin was bullish. The prices retested a crucial resistance in the vicinity of $30k. In particular, the $30.8k level served as resistance back in mid-April. A move above this level appeared likely.

The trend has been bullish in 2023, although that doesn’t mean a bull run was on. Above $30.8k-$31.5k, the next levels of resistance to watch out for are $32.8k and $34.5k. The 100% Fibonacci extension level at $34.2k was a valid bullish target, especially if BTC can breakout past $30.8k.

The RSI was above 70 to show overbought conditions and the CMF was at +0.1 to show significant capital flow into the Bitcoin market. They showed that Bitcoin was likely to continue on its upward trajectory.

Above the $30.8k resistance, there weren’t significant zones of opposition from the sellers until the $34k area. Hence, a move upward could see prices surge higher rapidly.

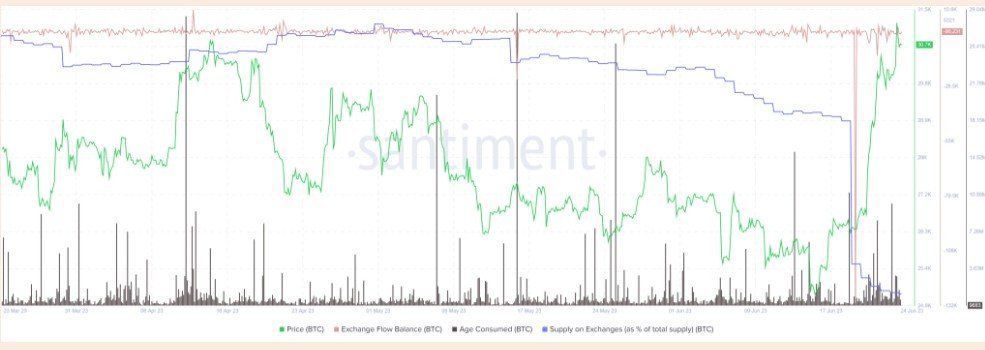

Bitcoin continues to flow out of exchanges, indicating spiking demand

Source: Santiment

The supply on exchanges metric has been steadily in decline since early May. This showed an increased withdrawal of Bitcoin from exchanges. The SEC’s stance against Coinbase and Binance could have played a part in fueling withdrawals as investors looked to take custody of their BTC elsewhere.

The rallying prices suggested that strong buying pressure over the past ten days was also a factor. The exchange flow balance dropped sharply on 19 June. Meanwhile, the age consumed also saw a few spikes over the past week.

22 comments