Is There a Strategy Better Than DCA?

TL;DR:

Dollar-Cost Averaging (DCA) and Value Averaging (VA) are two popular investment strategies for cryptocurrencies and other assets. DCA involves regularly investing fixed amounts regardless of market fluctuations, while VA allows for more active management based on market conditions. VA can be implemented with selling or holding the assets. In a hypothetical scenario with perfect growth, backtesting shows that VA with holding yields the best results, followed by VA with selling, and DCA performs the least. However, real-world performance may vary, and investors should consider their own preferences, goals, and risk tolerance before choosing a strategy.

When it comes to investing in cryptocurrencies and other assets, there are various strategies available to investors. Two popular strategies are Dollar-Cost Averaging (DCA) and Value Averaging (VA). Both approaches have their advantages and can be effective depending on individual preferences and investment goals. In this article, we will compare DCA and VA to determine if there is a strategy that outperforms the other.

Dollar-Cost Averaging (DCA) is a disciplined investment strategy that involves investing fixed amounts regularly, regardless of short-term price fluctuations. By consistently investing over time, regardless of whether the market is up or down, investors can potentially reduce the impact of market volatility and benefit from the long-term upward trend. DCA is suitable for individuals who prefer a regular and consistent approach to investing and are not actively managing their portfolio.

On the other hand, Value Averaging (VA) is a strategy that allows for more active management of investments based on market conditions. VA involves allocating more funds when prices are low and reducing exposure when prices are high. This approach aims to maximize gains during volatile periods by adjusting positions based on the target value. There are two variations of VA: VA with Selling and VA with Holding.

VA with Selling involves using a value averaging strategy but selling when the value exceeds the target each month. This strategy takes advantage of the rise in prices by gradually selling off a portion of the holdings, thus locking in profits. However, one drawback is that it ultimately results in owning less of the asset, which may not be desirable for investors aiming to accumulate larger holdings.

VA with Holding, on the other hand, uses a value averaging strategy but takes a payment break when the value exceeds the target. Instead of selling off the assets, the investor holds onto them, benefiting from the rising prices. This approach may result in a lumpier investment journey compared to DCA, but as prices rise and outpace the target value, the investor can pause payments and still maintain the desired portfolio value.

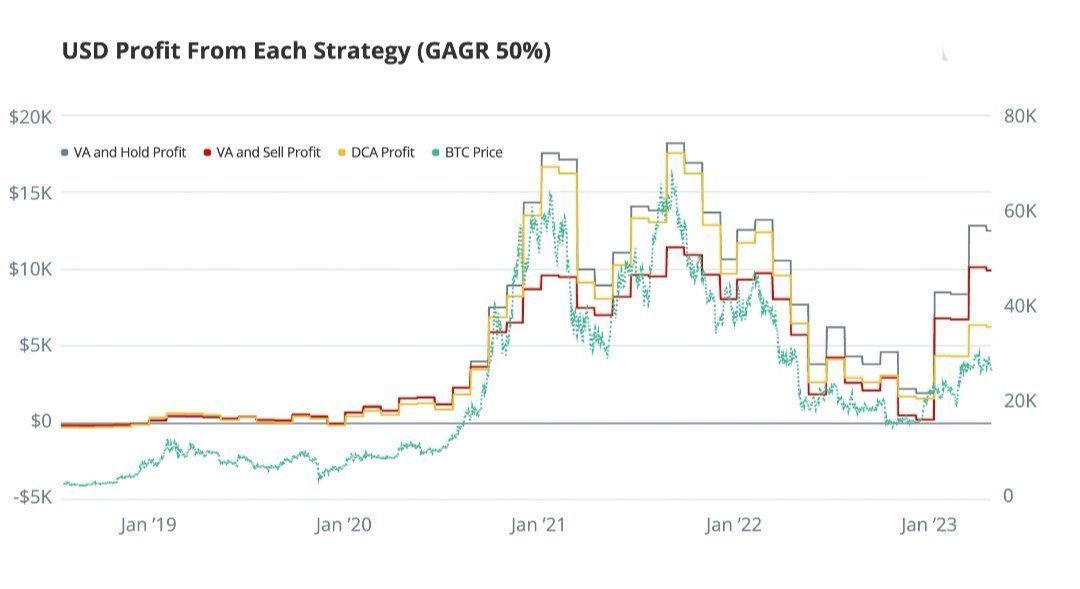

To compare these strategies, let's consider an example scenario where a monthly budget of $100 is invested on bitcoin, over a 32-month period. We assume perfect growth at compound annual growth rates (CAGR) of 57% and 80%. In this exercise, we can observe the outcomes of each strategy.

As expected, DCA steadily builds up the asset, but the gains decrease as the price rises. The costs of DCA increase gradually over time. The VA and Sell strategy demonstrate how profits can be generated by gradually selling off a portion of the asset as prices rise. However, this results in owning less of the asset in the end. The VA and Hold strategy, which involves holding onto the assets when the value exceeds the target, yields the best results in this particular exercise.

Through backtesting, we can see that, out of the three strategies examined, the VA and Hold strategy yields the best results, followed by VA and Sell, and lastly, DCA. However, it's important to note that this exercise is based on specific assumptions and market conditions. Real-world performance may vary, and it's crucial for investors to conduct thorough research and consider their own risk tolerance, investment horizon, and level of involvement in managing their portfolio before deciding on a strategy.

In conclusion, both DCA and VA have their merits, and the choice between the two ultimately depends on individual preferences and goals. DCA offers a disciplined and consistent approach, whereas VA allows for more active management and potential gains during volatile periods. Investors should carefully consider their own circumstances and objectives before selecting a strategy.

10 comments