Bitcoin: What to expect as consolidation draws to a close

Bitcoin’s Open Interest has been down significantly over the last four weeks. The king coin’s funding rates have dropped considerably in the same time frame.

Bitcoin showed signs that consolidation was coming to an end, but demand remained low.

BTC’s price action suggested that a crash to $28,000 could still be on the cards.

If you have been keeping a close eye on Bitcoin [BTC], then you may have noticed consolidation for the last four weeks. Recent findings suggested that the cryptocurrency was about to break out of its consolidation zone.

As per Twitter account woonomic, Bitcoin might be headed towards the end of its consolidation phase. The claim is based on rising futures’ demand, which has been on an uptrend even though Bitcoin’s price action has been sideways.

This suggests that there is currently a bullish bias, especially in the derivatives segment.

Early signs that BTC consolidation is nearing completion (FSI chart below).

Futures demand is currently moving the market, this demand has been climbing against sideways price action (this is bullish).

Volatility dynamics also signalling a larger move is probable. pic.twitter.com/WkmiQO0B17

— Willy Woo (@woonomic) July 20, 2023

The same findings suggest that the market might be about to experience a resurgence of volatility. But is Bitcoin experiencing robust demand in the derivatives segment?

Well, Bitcoin’s Open Interest has been down significantly over the last four weeks. Similarly, Bitcoin funding rates dropped considerably in the same time period.

Source: CryptoQuant

These findings are likely due to the low volatility that has prevailed during the latest consolidation phase. This confirmed that the demand was not quite there yet. If the bullish expectations turn out true, we will likely see a surge in demand for BTC this weekend and perhaps even in the coming week.

Will Bitcoin bears dominate?

BTC’s price action demonstrated some sell pressure since mid-July. This suggests that there is still a likelihood that it may experience more sell pressure contrary to expectations. Such an outcome could push the price back to the ascending support level.

This means we could see another unexpected dip below $28,000.

Source: TradingView

So far, we have witnessed some weakness in Bitcoin’s price action below the $30,000 range. This outcome could wipe out some investor confidence, possibly leading to more downside.

On the other hand, the MFI indicates that liquidity is gradually flowing back into Bitcoin. The RSI is also perfectly positioned for a potential bounce back at the 50% level.

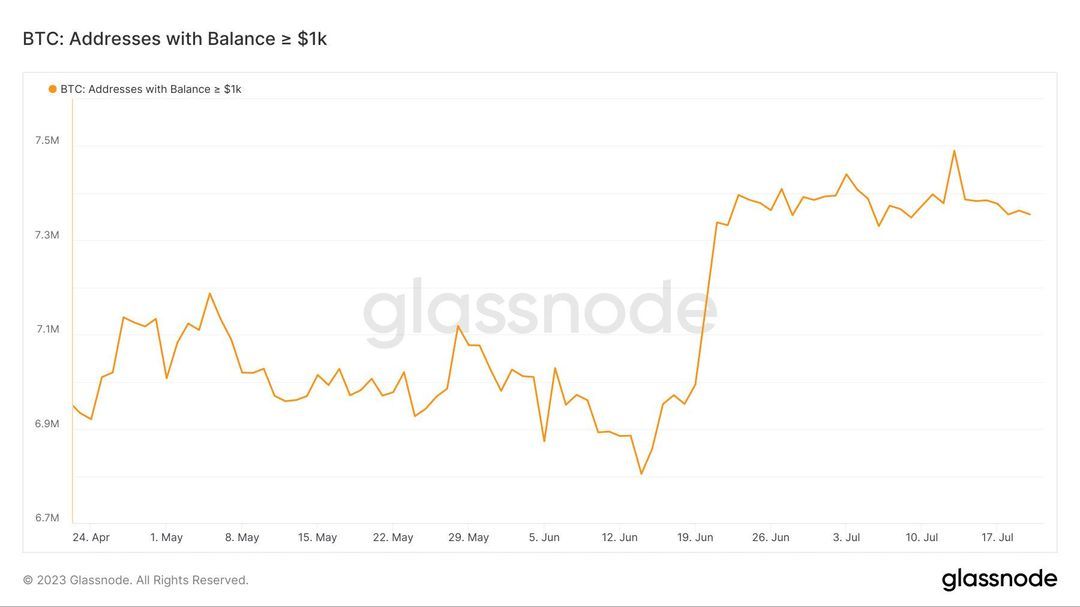

A look at Bitcoin metrics offers a bit of insight into BTC’s state. Ultimately, the fate of Bitcoin lies in the hands of addresses with large balances: whales. Addresses holding over 1000 BTC have been trimming their balances since 13 July.

Source: Glassnode

Despite the slight outflows, the same metric indicates that the levels held by whales are still notably high, especially compared to the lowest levels in June.

This once again points to the fact that there is currently low sell pressure. As such, the eventual outcome could still be a toss-up. But that outcome could sway towards the bullish side, thanks to institutional demand.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

9 comments